Trusted by 100+ world class organizations

Identify deal opportunities that truly match your mandate.

Superior technology. Superior deal sourcing.

Cyndx is an AI-powered search and discovery engine built to simplify deal origination.

Instead of relying on keywords, static company classifications, and historical data, Cyndx utilizes artificial intelligence (AI) and natural language processing (NLP) to ingest, analyze, understand, and deliver a precise actionable list of right deal opportunities, right now.

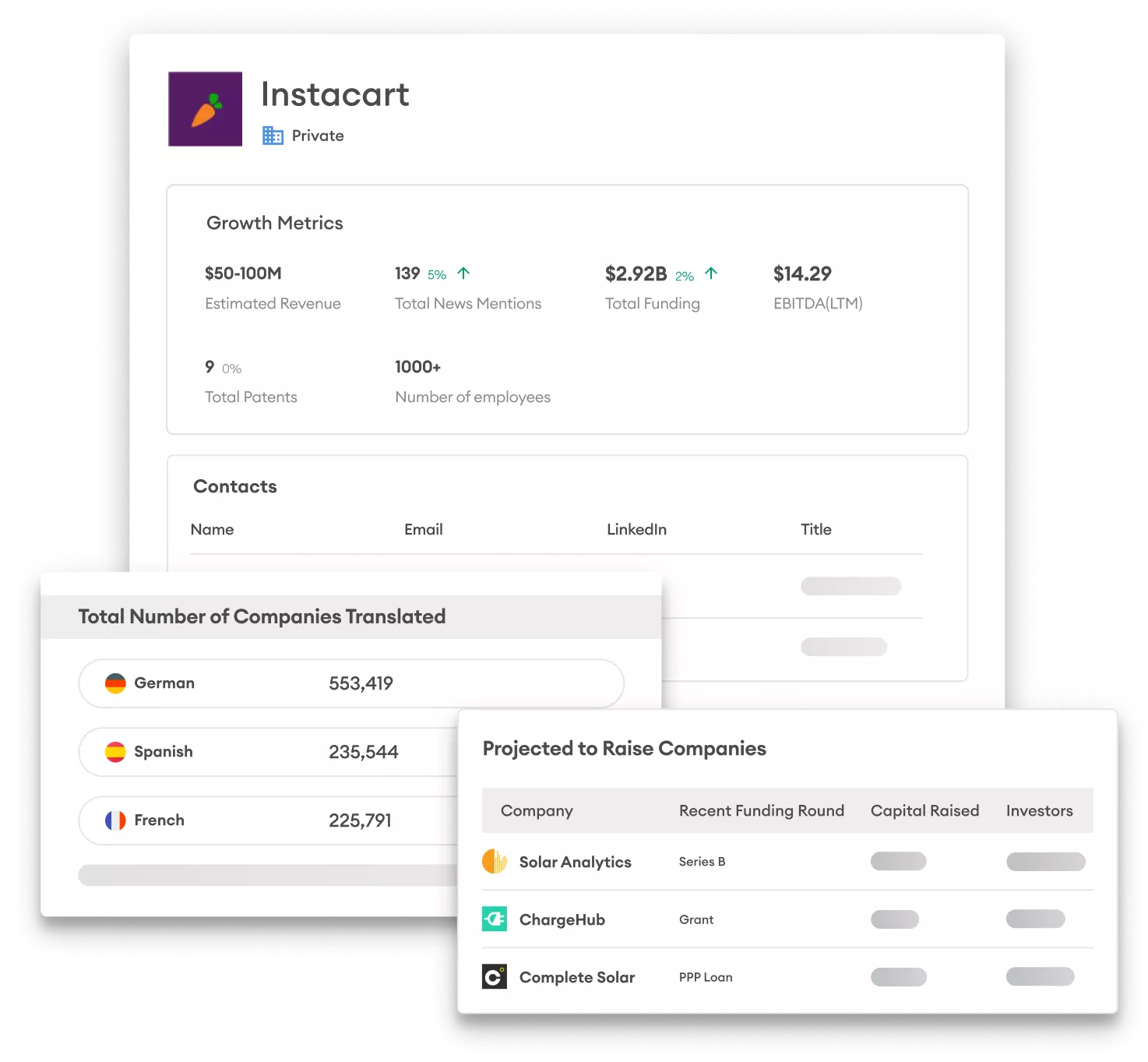

Access private market data.

Cyndx’s dynamic, NLP algorithm evolves with changing markets. Our data ingestion allows users to get up-to-date market data for any sector or sub-sector that enables you to rapidly map niche markets and industries for your deals.

Dynamic, NLP-derived taxonomy evolves with changing markets

Up-to-date market data for any sector or sub-sector

Rapid mapping of niche markets and industries

Get unique, actionable insights.

Identify companies projected to raise capital with robust profiles with funding, growth metrics, IP, financials, and contact information for quality-assured deal results and 86.1% precision.

Quality-assured results for greater precision

Identify companies projected to raise additional capital with over 86% precision

Robust profiles with details on funding rounds, growth metrics, IP, financials, and contact information

Find private companies or investors in seconds.

Curate comprehensive lists of the most relevant deal targets using similarity scores, portfolio insights, and company growth metrics with a straightforward search interface that is easy to learn and use to help jumpstart evaluation.

Curate comprehensive lists of the most relevant deal targets

Straightforward search interface is easy to learn and use

Similarity scores, portfolio insights, and company growth metrics help to jumpstart evaluation

Our Products

Deal Origination

- Find acquisition targets.

- Screen companies projected to raise capital within 6 months.

- Precise search queries and actionable lists of the right opportunities.

Investor Identification

- Create lists based on investor type, geography, investment preferences and median deal size, among many others.

- Recommendations from 150,000+ investors and 3,100 family offices.

- Find the most active investors in any industry—access to 40M business contacts.

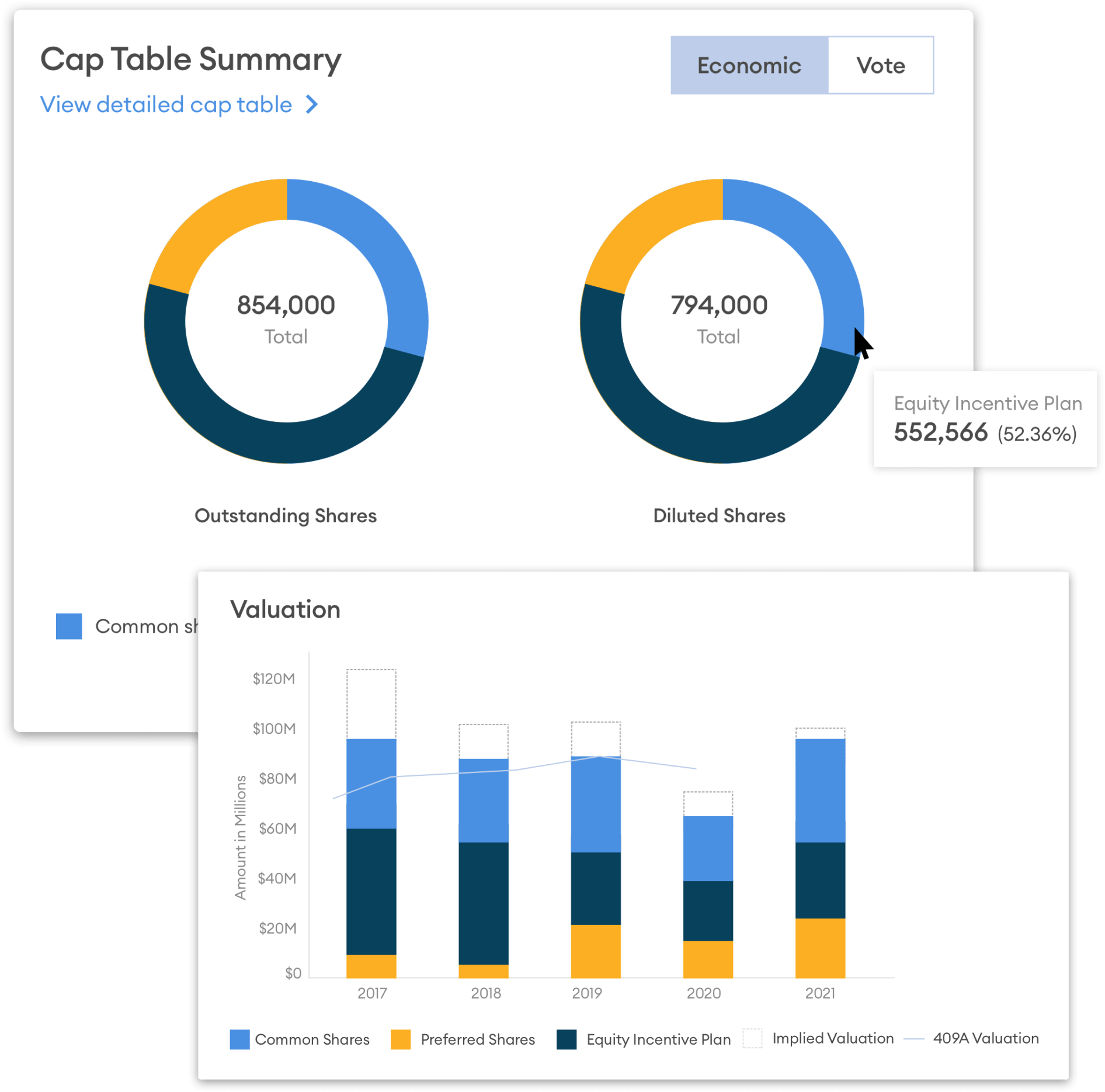

Cap Table Management

- Store and manage all corporate documents and be diligence ready.

- Track and manage equity ownership warrants, options and debt classes as well as employee stock incentive programs.

- Waterfall analyses and scenarios against incoming term sheet offerings.

Featured in

Cyndx is bringing a disruptive, tech-enabled approach to investment analysis, private capital sourcing, and M&A advisory.

Oskar Mielczarek de la Miel Managing Partner, Rakuten Capital

Explore our resources.

Learn more about what’s happening in the market right now that can help

your business grow.

Frequently Asked Questions

Find answers to most commonly asked questions related to our products and services

Cyndx is an AI-driven financial technology company that provides a platform to simplify fundraising and M&A activities. Cyndx uses its advanced algorithms to accurately curate and rank investor lists, increasing the efficiency of capital raising and M&A transactions for entrepreneurs, private equity firms, venture capital firms, and more.

With Cyndx, you can discover potential acquisition targets, identify strategic partners, and access market insights to support growth strategies.

Yes, Cyndx provides businesses with a powerful platform for deal sourcing, helping them discover and evaluate potential investment opportunities, strategic partnerships, and acquisition targets. The platform offers access to company profiles, financial information, growth metrics, funding history, and industry trends to support informed decision-making.

It offers access to a vast database of companies, investors, and market insights to support informed decision-making.

Yes, Cyndx Valer derives your company’s value using Cyndx’s massive dataset and AI-powered methods. In less than an hour, you get a valuation analysis that you can present to banks, investors and acquirers.

Cyndx is bringing a disruptive, tech-enabled approach to investment analysis, private capital sourcing, and M&A advisory.